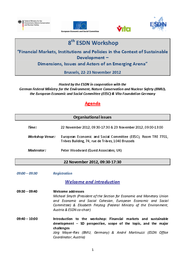

22 - 23 November 2012, Brussels, Belgium

The 8th ESDN Workshop took place in Brussels on 22-23 November 2012. The workshop was entitled "Financial Markets, Institutions and Policies in the Context of Sustainable Development - Dimensions, Issues and Actors of an Emerging Arena". In total, 53 participant from 14 European countries and Japan attended the workshop.

The workshop intended to scope the mechanisms and operational design of financial markets, explore the functional and dysfunctional aspects in a SD perspective and, on this basis, develop concrete fields of action for SD policy related to financing, financial markets and finance governance. The outcomes of the workshop provide an orientation for SD policy-makers in the debate around the financial markets and future policy options in their administrations. In addition, it brought together actors from different fields to discuss and learn from their respective experiences to develop suggestions how the financial markets could better serve SD objectives. The workshop focused on questions such as: What are the conceptual frames, the framework conditions, mechanisms and recent developments of financial markets? What exact impacts does the current financial market system have on SD policy and practice? How can financial market reforms and additional instruments and institutions be designed in order to enhance SD? How are sustainable investing practices affected by other events and upheavals in financial markets, such as the financial crisis or the current Euro crisis? To what extent do (or should) investors reflect on SD objectives in their investment decisions?